are delinquent taxes public record

Because record ownership as of January 6 is so crucial local governments should make it their practice to update real property ownership listings as of January 6 each year before they take any action on delinquent real property taxes. Assume Billy Blue Devil owns Parcel A in Carolina County.

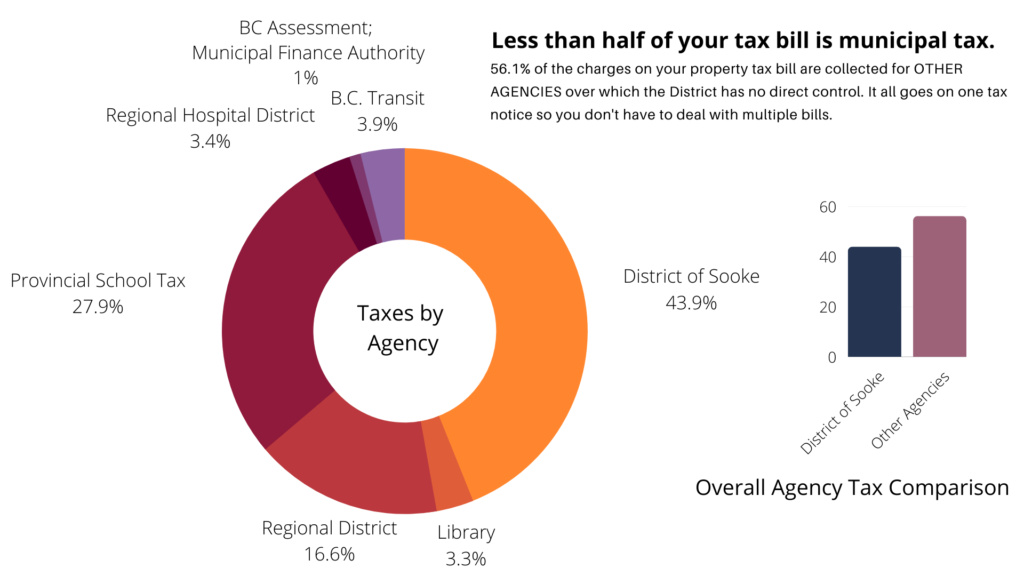

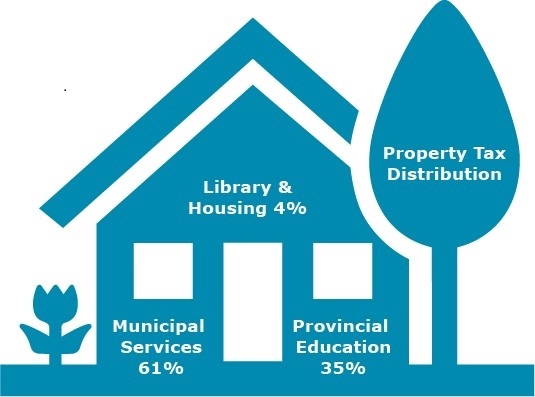

Property Taxes Strathcona County

Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all.

. These remedies include but are not limited to. Home News Public Records Legals Delinquent Taxes. He sells it to Tina.

Arkansas County Assessor and Collector. Though tax liens are public legal documents accessing. Governments issuing public tax delinquents lists sometimes argue that a tax lien has been filed17 making the unpaid debt a matter of public record18 This is true in the most basic sense but it misses significant differences in the accessibility of and purpose behind tax delinquents lists and tax liens records.

ALL PERSONS WITH A LEGAL INTEREST IN THE PARCELS OF REAL PROPERTY DESCRIBED IN THE FOLLOWING DELI Skip to main. The Chancery Court Clerk and Masters Office generally holds one sale per year for delinquent property taxes owed to Rutherford County Murfreesboro Smyrna and LaVergne. Publication of Delinquent Personal Property Taxes.

Delinquent tax records are handled differently by state. Personal Property taxes that are unpaid October first of the current tax year are published in a county newspaper of general circulation in compliance with KSA. Publication Of Delinquent Personal Property Taxes.

For 2019 2020 and 2021 taxes please visit the Cook County Treasurers website. The property is sold at public auction which takes place at the County Courthouse. NOTICE OF DELINQUENT TAXES State of Minnesota District CourtCounty of Steele 3rd Judicial District TO.

Are delinquent taxes public record. More Information For more information on the programs available to you please contact us at 937 562-5672. Attachment and garnishment of funds due to the taxpayer.

More info for View the Public Disclosure Tax Delinquents List Before a taxpayer appears on this list they have already been notified via letter from the Department of Revenue as required by law. An additional 30 fee will be added to all real property bills and an additional 40 fee will be added to all mobile home bills if the taxes penalties and assessment fees are not paid by 500 PM on Friday April 22 2022. Phone 989354-9534 Fax 989354-9645.

Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office. This affects the ability to display the 2021 tax payments on our website. Seizure and sale of personal property.

Delinquent Taxes and Tax Foreclosure Auctions. Delinquent Taxpayer Publication - This publication lists delinquent taxpayers with prior year delinquent taxes. You or a representative must be present to bid.

Heres how the record-owner rule might work in practice. 19-547 for 3 consecutive weeks in October in the official county newspaper. Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes.

The warrant or lien is a public record filed with the Clerk of Court or other government office in the county where the taxpayer is located. Seizure of state income tax refunds and lottery winnings. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of.

If you fall behind on your taxes numerous payment options are available. You may also contact us directly at 407-665-7636. For 2019 2020 and 2021 taxes please visit the Cook County Treasurers website.

Any unpaid balance due may then be subject to sale to a third party. In counties where no taxpayer has warrants or liens totaling 100000 the two taxpayers with the highest amount of warrants or liens are included. To see if your taxes have been sold forfeited or open for prior years currently defined as 2018 and earlier please enter your property index number PIN in the search box below.

Every effort is made by the Greene County Treasurers Office to work with taxpayers who have fallen behind on their taxes. Visit Our Website Today Get Records Fast. All taxpayers on this list can either pay the whole liability or resolve the liability in a way that satisfies our conditions.

If left unpaid the liens are sold at auctions to the public. Eventually the lien owners may have to force foreclosure on the property to pay the liens. Delinquent Property Taxes Online.

The North Carolina General Statutes NCGS provide taxing jurisdictions with several collection remedies to enforce collect delinquent taxes. If you need confirmation of the 2021 payment please email your request to taxdepartmentseminolecountytax including your name parcel or tax bill number and the address of the property. Tax Record Search and Online Payments Spartanburg County Taxes pageDescription.

2JEFFERSON The Ashtabula County Treasurers Office concluded its 2022 tax collection securing a record-breaking 110 million in total collections with more than 44. Seminole County Tax Collector PO Box 630 Sanford FL 32772-0630 407 665-1000 Email Contacts Email Public Records Custodian.

Property Taxes Strathcona County

How To Find Out If Property Taxes Have Been Paid

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

How Do Tax Liens Work In Canada Consolidated Credit Canada

Buying Property Through Tax Sales

How Can I Find Out If Someone Paid Their Property Taxes Nj Com

Property Taxes Haldimand County

Received A Mecklenburg County Tax Foreclosure Notice Facing Charlotte Tax Auction

6 Things To Know About Property Titles

Crystal Ins Shares See Surprise Rise In Demand Initial Public Offering Listed Company Business Pages

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)

Tax Lien Certificate Definition

Unfair And Unpaid A Property Tax Money Machine Crushes Families

/edit_BAG5628-d1d046715e1748c88a36ccd84731b1df.jpg)